Environmental Regulations Updated for Plastic Toys: The Impact of the Global RoHS 2.0 Standard on Wholesalers

I. Core Updates of the RoHS 2.0 Standard: A New Compliance Red Line for the Plastic Toy Industry

The EU’s (EU) 2015/863 amendment, released in 2015, comprehensively upgraded the scope and types of substances controlled by the RoHS 2.0 standard, directly impacting the plastic toy supply chain:

Four New High-Risk Substances Added: Phthalate plasticizers (DEHP, BBP, DBP, DIBP) were officially included in the restricted list, with a limit of 0.1% (1000 ppm) for each substance. These substances are widely used in soft plastics, cable sheaths, coatings, and other toy components, and have reproductive toxicity and ecological hazards.

Full Product Coverage: “Toys, leisure and sports equipment” (especially electrically powered toys) are explicitly included in 11 categories of controlled products. Any product containing electronic components (such as sound-generating devices, LED components, and electric drive systems), regardless of whether the core material is plastic, must comply with the requirements. **Strengthened Certification and Surveillance:** Compliance is now a mandatory requirement for the CE marking. Wholesalers are required to provide technical documentation and declarations of conformity with their shipments. The EU and many other countries have established unified market surveillance mechanisms, and non-compliant products will face recalls, fines, and even market bans.

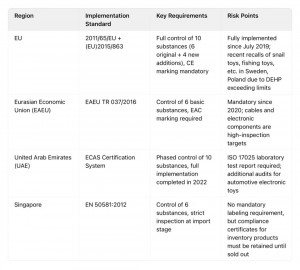

**II. Global Implementation Differences of RoHS 2.0: Cross-Market Compliance Challenges for Wholesalers** Significant differences exist in the adoption and implementation of RoHS 2.0 across different regions, directly impacting wholesalers’ global operations.

**III. Three Core Impacts Faced by Wholesalers**

**Surge in Supply Chain Compliance Costs:** The newly added testing for four types of phthalates requires sophisticated methods such as gas chromatography-mass spectrometry (GC-MS), increasing the cost per test by 30%-50% compared to the original standard. This also requires coverage of multiple components, including plastic parts, coatings, and adhesives. Simultaneously, supplier qualifications need to be re-evaluated, and eliminating non-compliant production capacity may lead to a 15%-20% increase in procurement costs. Increased Inventory Impairment Risk: Non-compliant existing products cannot enter core markets such as the EU and the UAE. If new restricted substances are involved, the recall process requires coordination with distributors and retailers to complete returns and exchanges, with an average processing cycle of 3-6 months, resulting in capital tied up and reputational damage.

Increased Compliance Complexity Across Markets: Differences exist in the quantity of controlled substances, certification marks (CE/EAC), and testing standards (IEC 62321/EN 62321) across different regions. Wholesalers need to customize compliance solutions for target markets, avoiding the misconception that “one test report is acceptable globally.”

IV. Compliance Breakthrough Strategies for Wholesalers

Establish a Tiered Supply Chain Management System: Require upstream manufacturers to provide full-item RoHS 2.0 test reports (including the newly added four categories of phthalates), and prioritize suppliers with ISO 17025 laboratory certification; sign compliance responsibility agreements, clearly stipulating that material changes must be notified 30 days in advance.

Optimize inventory and testing processes: Categorize and test products for sale according to target markets; conduct random sampling inspections on high-risk products (soft plastic toys, electrically powered toys) for each batch; establish an inventory early warning mechanism to proactively review compliance for products nearing their expiration date, avoiding the risk of unsold inventory.

Develop global compliance certifications: For the EU market, ensure products bear the CE mark and retain technical documentation (for at least 5 years); for the Eurasian Economic Union, apply for EAC certification in advance; for markets such as the UAE and Singapore, prepare corresponding testing reports and declarations of conformity.

Technology substitution and product upgrades: Encourage suppliers to use environmentally friendly plasticizers (such as citrate esters) to replace restricted substances such as DEHP and DBP; simplify unnecessary electronic components to reduce the complexity of compliance testing, while increasing the environmental premium of products.

Post time: Nov-19-2025